Your Cryptocurrency Tax Guide

Bitcoin investing has become increasingly popular over the past year. In December 2021, Grayscale Investors found that more than half of the current Bitcoin investors had begun investing in Bitcoin during the previous 12 months.

Like many others, you may find cryptocurrencies to be an intriguing new investment opportunity. You may accordingly have already begun investing in cryptocurrencies or plan to begin investing in cryptocurrencies. Either way, you should be aware that certain cryptocurrency transactions are taxable events.

Not Taxable

As with buying stock, simply buying virtual currency with real dollars is not a taxable transaction. Other stock tax exemptions also apply to cryptocurrency. You would not be taxed for donating cryptocurrency to a tax-exempt organization or for gifting cryptocurrency (as long as the gift was valued at $15,000 or less). Finally, transferring cryptocurrencies from one of your wallets to another is not a taxable event.

Taxed as Capital Gains

As you likely know, selling stock in a taxable account will result in a capital gain or loss. Selling cryptocurrency also results in a capital gain or loss. The cryptocurrency’s market value at the time of purchase is called its cost basis. When you sell cryptocurrency, you will either sell the virtual currency for more than its cost basis, resulting in a capital gain, or for less than its cost basis, resulting in a capital loss. As is the case with stock, cryptocurrency held for longer than one year results in a long-term gain or loss, and cryptocurrency held for less than one year results in a short-term gain or loss.

Beyond selling cryptocurrency for cash, trading one currency for another or using virtual currency to buy a good or service would also trigger a capital gain or loss.

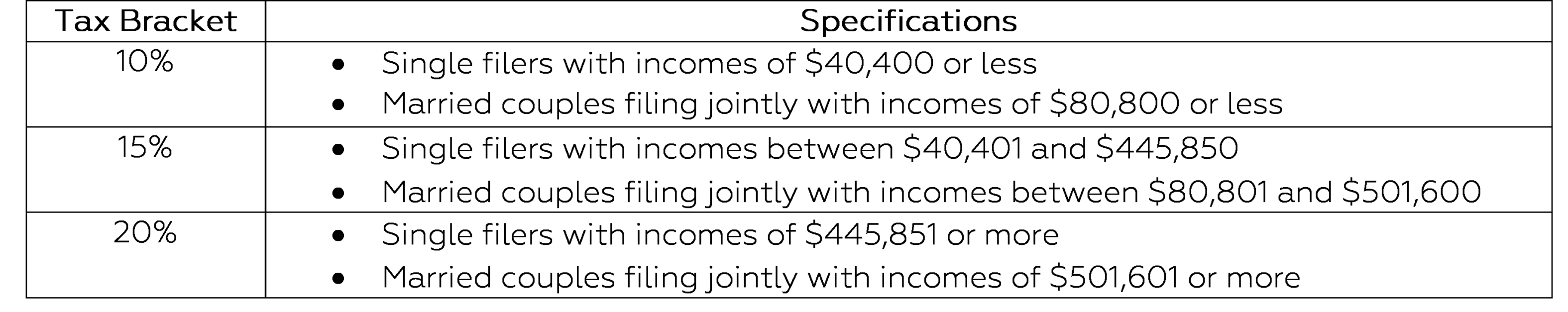

Short-term cryptocurrency gains will be taxed as ordinary income, and long-term cryptocurrency gains will be taxed according to the 2021 long-term capital gains rates. Up to $3,000 in capital losses can be deducted from your taxable income.

2021 Long-Term Capital Gains Rates

Stock brokerage companies are required to provide you with a Form 1099, detailing your capital gains and losses for the year. Stock investors accordingly need not track the value of their stocks when they are bought or sold. The brokerage firm will do this work for you, and you can use your Form 1099 to calculate your capital gains tax bill on your tax return.

However, many cryptocurrency exchanges do not currently provide a Form 1099. If you are a current cryptocurrency investor, you will likely be responsible for tracking the value of your shares. I encourage you to keep a detailed account of your cryptocurrency transactions, including the date, value, and type of transaction. You should records each time you receive, sell, or exchange cryptocurrency. You can click here and download Elm3’s Cryptocurrency Trading Tracker to assist you in tracking your cryptocurrency transactions.

However, you will not need to track your cryptocurrency transactions forever. The recently-enacted infrastructure bill requires cryptocurrency exchanges to issue a Form 1099-B, beginning with the 2023 tax year.

Taxed as Income

Cryptocurrency received as payment for services will be taxed as ordinary income. This rule applies if cryptocurrency is received as an income payment, as a reward for certain activities, or as a result of mining Bitcoin.

According to the IRS, “A taxpayer who receives virtual currency as payment for goods or services must, in computing gross income, include the fair market value of the virtual currency, measured in U.S. dollars, as of the date that the virtual currency was received.”

As I discuss above, it is accordingly important for you to track the nature, date, and value of each of your cryptocurrency income transactions.

Next Steps

Current cryptocurrency investors would likely benefit from working with an experienced tax professional in preparing their 2021 return. Make sure to provide this professional with your detailed cryptocurrency transaction records, such that the professional can accurately calculate your tax refund or bill. As always, our experienced tax team would be happy to assist you in navigating the cryptocurrency taxation laws.