Unenrolling from Monthly Child Tax Credit Payments

Unenrolling from Monthly Child Tax Credit Payments

By: Stacey Nickens

In July, the IRS began sending out advanced payments of the 2021 Child Tax Credit. You may be interested in opting out of these advanced payments for a number of reasons. Because these are advanced payments of a credit, every dollar you receive this year will reduce the amount of Child Tax Credit that you can claim on your 2021 return. Accepting advanced payments of the Child Tax Credit could thus reduce your 2021 refund or increase your 2021 tax bill. Unenrolling from advanced payments would prevent you from encountering those issues.

In order to unenroll from receiving advanced Child Tax Credit payments, visit www.irs.gov/credits-deductions/advance-child-tax-credit-payments-in-2021. You will then click the button that says, “Unenroll from Advance Payments”. Unless you have an existing IRS username and password, clicking this button will redirect you to ID.me. From there, you will create an ID.me account. You will upload a copy of your driver’s license or another photo ID. The program will then scan your face to ensure that it matches the uploaded ID. It is recommended that you complete this step on a cellphone or a computer with a built-in camera.

Once you have created your ID.me account, you will be able to unenroll from receiving advanced payments. Spouses whose filing status is Married Filing Jointly will both need to unenroll from receiving advanced payments. If only one spouse unenrolls, the enrolled spouse will still receive half of the advanced payment due to your family.

If you share custody of your child, the parent or guardian who claimed the child on their 2020 return would receive the advanced Child Tax Credit payments. You may have claimed your child on your 2020 return but another adult is supposed to claim your child on their 2021 return. If that is the case, you should unenroll from payments before they are automatically sent to you.

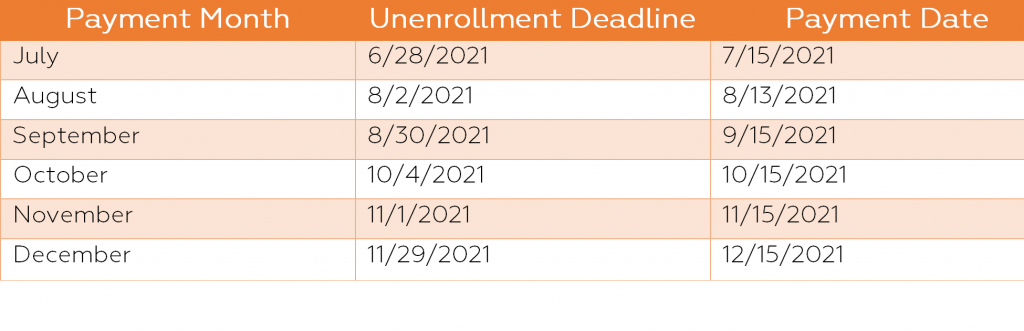

Advanced Child Tax Credit payments will be sent out on the 15th of each month, beginning in July and continuing through December. To stop advance payments, you must unenroll 3 days before the first Thursday of each month. Please see the unenrollment and payment deadlines below. Once you have unenrolled from advanced payments, you cannot re-enroll at this time. The IRS says they will open a re-enrollment process in September 2021.

Your unenrollment request may take up to seven days to process. The IRS recommends re-checking the portal to ensure that your request was processed successfully.

Your unenrollment request may take up to seven days to process. The IRS recommends re-checking the portal to ensure that your request was processed successfully.

If you have any questions about the Advanced Child Tax Credit payments, please do not hesitate to reach out. Our experienced team of tax professionals is available to assist you in this process.